Low-rate digital payments and advanced FX solutions, from anywhere in the world.

Business Fintech’s dynamic platform offers the most effective solution for your international business, from fast payments to robust hedging solutions.

Send & receive international payments.

Do business in real time, without the high transaction fees and long delays.

Increase revenue with reduced rates

We offer the most competitive prices for international payments: Forget sky-high fees and hidden charges.

Make every moment count with swift payments

Complete same-day payments between Europe, USA and the UK for preferred rates.

Do business across borders

Operate 24/7 in any time zone with your free multi-currency account.

International transactions are made effortless with great rates, low conversion fees, and over 140 available currencies.

Just like a bank (minus the headaches)

Opening an account takes seconds, and you’ll receive your own IBAN in just 1-2 days.

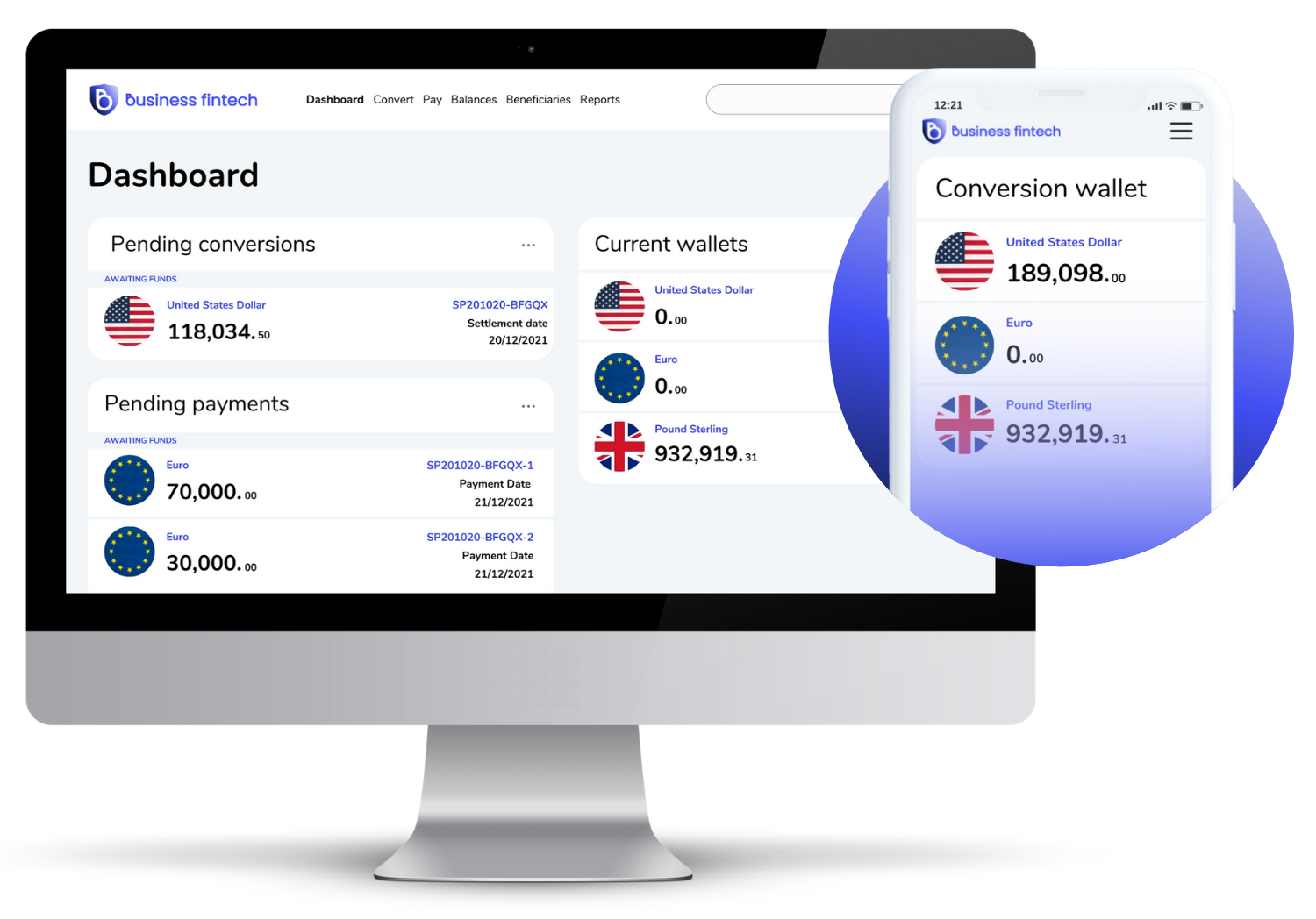

Easily manage transactions.

One platform, zero hassle. Access all your accounts and process global payments in one place with Business Fintech’s secure online portal.

Freely manage multiple accounts

Harness the power of a unified payment portal by seamlessly managing domestic and international accounts and transactions.

Working around your clock

Our schedule is your schedule. Manage, analyze, send and receive payments when you need them.

Stellar performance that looks good doing it

Our simplified, intuitive platform is easy on the eyes.

Conveniently manage beneficiaries and initiate payment instructions.

Enjoy instant PDF confirmations of trades, and automatic notifications for every step of the transaction processing.

One workflow means a simpler operation.

Business Fintech offers a free multi-currency account in more than 140 currencies, so you can easily do business with your multinational customers, suppliers and subsidiaries.

Eliminate confusing conversions

Build trust by giving your customers the option to pay in their local currency.

Freely save various currencies in your account for later use, or convert them at advantageously low rates.

Open accounts abroad

You’ll no longer need a physical presence in each country you do business.

Easily meet payment compliance requirements by large companies requiring local bank accounts like Stripe and Amazon.

Open an account in your name with a personal IBAN in 1-2 working days.

100% guaranteed

Your funds are held in segregated accounts located in the UK, USA or Europe, depending on your operational needs.

Safeguard revenue with our vast range of hedging solutions.

Our tailored strategies offer safe and effective methods to protect your margins from market volatility.

Protect your profits with our currency risk management solutions.

Lock in exchange rates in advance for a closer eye on future cash flows.

Mitigate exchange risks for invoices in foreign currencies due to market volatility.

Centralized, streamlined management of your hedging operations at-a-glance.

Enjoy a wide range of hedging solutions on over 75 currencies, for maturities ranging up to 5 years. Instruments include flexible and fixed-term forward contracts, FX options, and NDFs (Non Deliverable Forwards).

No initial guarantee deposit on forward exchange lines (subject to approval).

Receive expert strategic guidance from a dedicated manager who will inform you when market conditions are optimal.

Take advantage of flexible financing solutions.

Expand working capital and optimize cash flow.

Gain additional negotiating power with suppliers and customers

Expedite operations with a credit line that’s free to set up, and allows you to pay suppliers and collect receivables without delay. With approval, receive a credit line of up to 3 million euros.

Importers may gain additional leverage to lower purchase prices by paying suppliers immediately upon invoice receipt, with up to 150 days to repay.

Exporters may win new markets by granting customers longer payment terms when their receivables are settled upon presentation of invoices, with up to 120 days to repay commercial debt.

Enjoy a streamlined and paperless operation

Complete with a dedicated financial advisor to assist you.

More than meets the eye.

Business Fintech is pleased to simplify your multinational financial operations:

In the new age of global fintech, gone are the days of costly and outdated international money transfers, which can leave your business vulnerable to routing errors, long lead times and rejected payments.

Simple & Fast Onboarding

Open a Business Fintech account in just seconds, and be up and running in as little as 24 hours.

Safe, Secure & Compliant

We’ve got our guard up. We utilize world-class, ultra-secure technology of the highest standards along with regulated and reliable liquidity providers to ensure your business is quick, compliant and protected. We guarantee safe, streamlined business for you and your partners.

A First-Class Ticket to Increased Revenue

A multi-currency account means you can store, send and receive over 140 currencies, from anywhere in the world, without the hassle of lag time or processing delays.

No Hidden Charges

We’re really proud of our industry partnerships because they mean super-low prices for your payments, and no surprises. No ancillary fees, no exchange commission, no account activity charges, and no maintenance fees.

Super-Low Transaction Rates

Buy and sell currencies at the most competitive market rates, adjusting in real-time to interbank spot rates. Reduce the difference between interbank and client rates offered by banks by 30% to 50%. Transfer fees range from zero to £20 maximum.

Cloud Based Service

Access anytime, anywhere: Our cloud technology is simple, centralized, and paperless.

The Business Fintech Advantage

Let’s keep in touch. Receive up-to-date guidance from dedicated support specialists here to provide assistance in real time.

Business Fintech is proud to support a vast array of sectors, from imports-exports, tourism and hospitality to real estate, digital services, private equity, and wealth management.

Our dynamic platform is strategy-driven and service-oriented, aimed at maximizing revenue potential whether you’re a multinational industry leader or an emerging SME.

With our powerful alternative banking solutions, your business will mitigate multi-asset risk, navigate volatility, and formulate bespoke hedging models with greater ease and transparency than ever before.

Provide assurance for investee companies with expert guidance on divestments, treasury management, and international investments.

Streamline FX execution capabilities with optimal rates for spot deals, and derivatives including forward contracts, options and non-deliverable forwards.

Expand your FX management solutions beyond a single bank or broker.

Measure and track performance with our comprehensive accounting reports and procedures for improved hedging calculations, margining and settlements.

We are committed to understanding the intricacies and nuances of your practice, which is why we work tirelessly to provide you with a range of products and services focused on scaling the efficiency and effectiveness of your operation. We’re here for you.

A Business Fintech account offers an unparalleled solution, tailored to your operation’s unique needs.

Business Account

For executives and their treasury teams who operate across major currencies.

38 available currencies for purchase

33 available currencies for sale

Third party account payments

Multi-currency nominative collection accounts

Fixed and flexible forward contracts

5% guarantee deposit for currency hedges

Management of margin calls by contract

1 year maximum maturity of hedges

Online platform

Institutions Account

For companies looking to manage transactions across a wider range of currencies, while hedging risk with forward contracts.

140 available currencies for purchase

55 available currencies for sale

Third party account payments

Multi-currency nominative collection accounts

Fixed and flexible forward contracts

0% guarantee deposit for currency hedges

Management of margin calls by contract

5 year maximum maturity of hedges

Credit line up to 3M€, repayable over 6 months

Online platform

Connectivity to ERP systems

Derivatives Account

For established organizations in need of tailored hedging solutions and risk relief across a variety of derivatives.

140 available currencies for purchase

55 available currencies for sale

Third party account payments

Multi-currency nominative collection accounts

Fixed and flexible forward contracts

FX options available

Non Deliverable Forwards (NDFs) available

0% guarantee deposit for currency hedges

Management of margin calls with OTM

5 year maximum maturity of hedges

Online platform

Enjoy low rates and transparent pricing.

Accessing and using the Business Fintech platform is completely free.

Transparent pricing without hidden charges, we charge a pre-agreed fixed spread or a set fee according to volume of payments.

Enjoy accounts in 55 currencies to receive payments, and no fees for outgoing wire transfers.

We’re proud to reduce the difference between interbank rates and the rates offered by your bank by 30% to 50%.

We’re giving exchange commissions a miss. Every time. We are deriving income from the spread applied.

Unlike banks, we don't charge any fees for setting up and trading forward contracts.

Based in London, UK

Business Fintech is honored to serve a diverse and distinguished international client base.

Dedicated to the service of keeping companies like yours running smoothly, we continuously commit to offering the most comprehensive solution in today’s international payment and foreign exchange markets.

Our global service spans 140+ currencies and incorporates a first-rate range of hedging instruments, placing us on our path to become the leading alternative to traditional banking for international payments and foreign exchange risk management in the UK, USA and Europe.

We look forward to becoming an integral part of your digital financial operation.